Not known Facts About Cash-Out Refinance Definition - Investopedia

More About Cash-Out Refinance - Wells Fargo

This means the re-finance settles what they owe and after that the debtor might be qualified for approximately 125% of their house's worth. The quantity above and beyond the mortgage benefit is provided in money much like an individual loan. Rate-and-Term vs. Cash-Out Refinancing As discussed, customers have a multitude of choices when it comes to refinancing.

Fastest How To Refinance A Mortgage With Cash Out

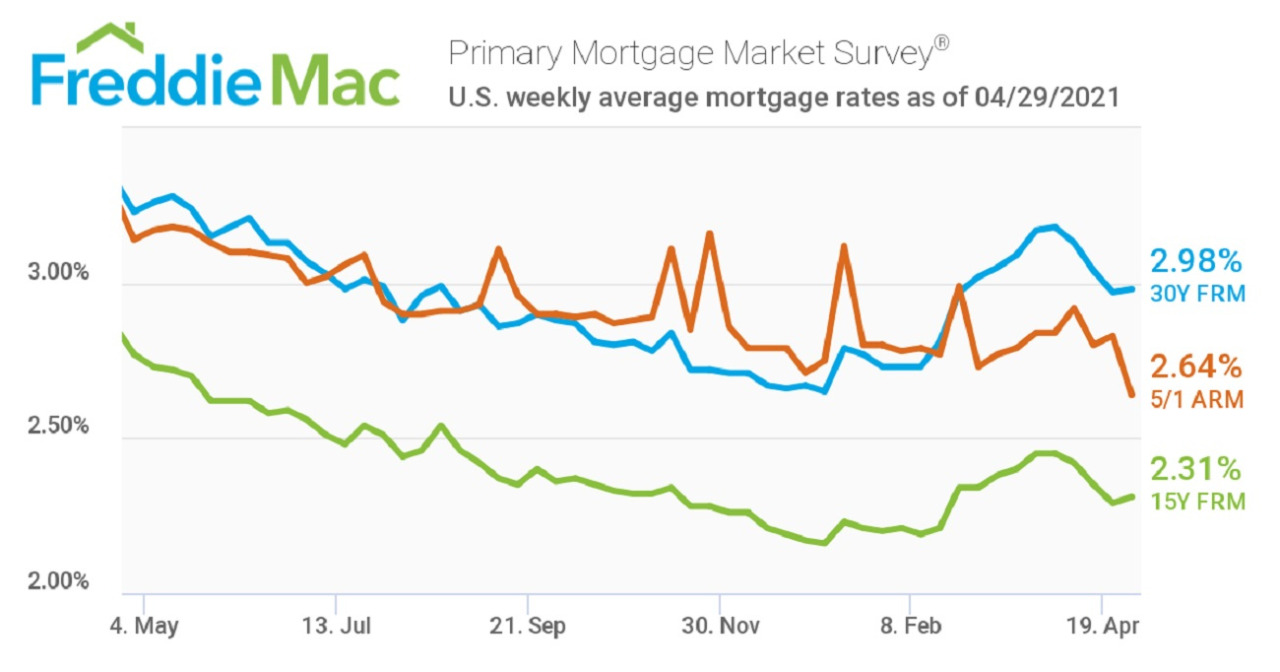

With this type, you are attempting to attain a lower rate of interest or adjust the term of your loan, but nothing else modifications on your mortgage. For example, if your home was acquired years ago when rates were greater, you might find it useful to re-finance in order to benefit from lower rate of interest that now exist.

With a rate-and-term re-finance, you might lower your rate, adapt to a 15-year payment, or both. Nothing else changes, just the rate and term. More In-Depth -out refinancing has a various goal. It allows you to use your home as security for a brand-new loan in addition to some money, creating a brand-new home mortgage for a bigger quantity than what is currently owed.

Get Best Mortgage Rates Today! - HomeRate Mortgage

This is possible since you just owe the loaning institution what is left on the original home mortgage quantity. Any extraneous loan quantity from the refinanced, cash-out home mortgage is paid to you in money at closing, which is usually 45 to 60 days from the time you use. Compared to rate-and-term, cash-out loans generally include greater interest rates and other costs, such as points.

The Main Principles Of Moreira Team Reviews - Atlanta, GA - Angie's List

A high credit rating and lower relative loan-to-value ratio can alleviate some concerns and assist you get a more beneficial offer. House equity loans and home equity lines of credit can be other alternatives to cash-out or no cash-out mortgage refinancing. Example of a Cash-Out Refinance State you secured a $200,000 home loan to buy a property worth $300,000 and after many years you still owe $100,000.

Best Cash-Out Refinance Lenders of 2021 - Rates & Reviews

If rates have actually fallen and you are wanting to refinance, you might potentially get authorized for 100% or more of your home's value, depending on the underwriting. Lots of people would not necessarily wish to take on the future concern of another $200,000 loan, but having equity can assist the amount you can receive as cash.